The Month that was : December 2024

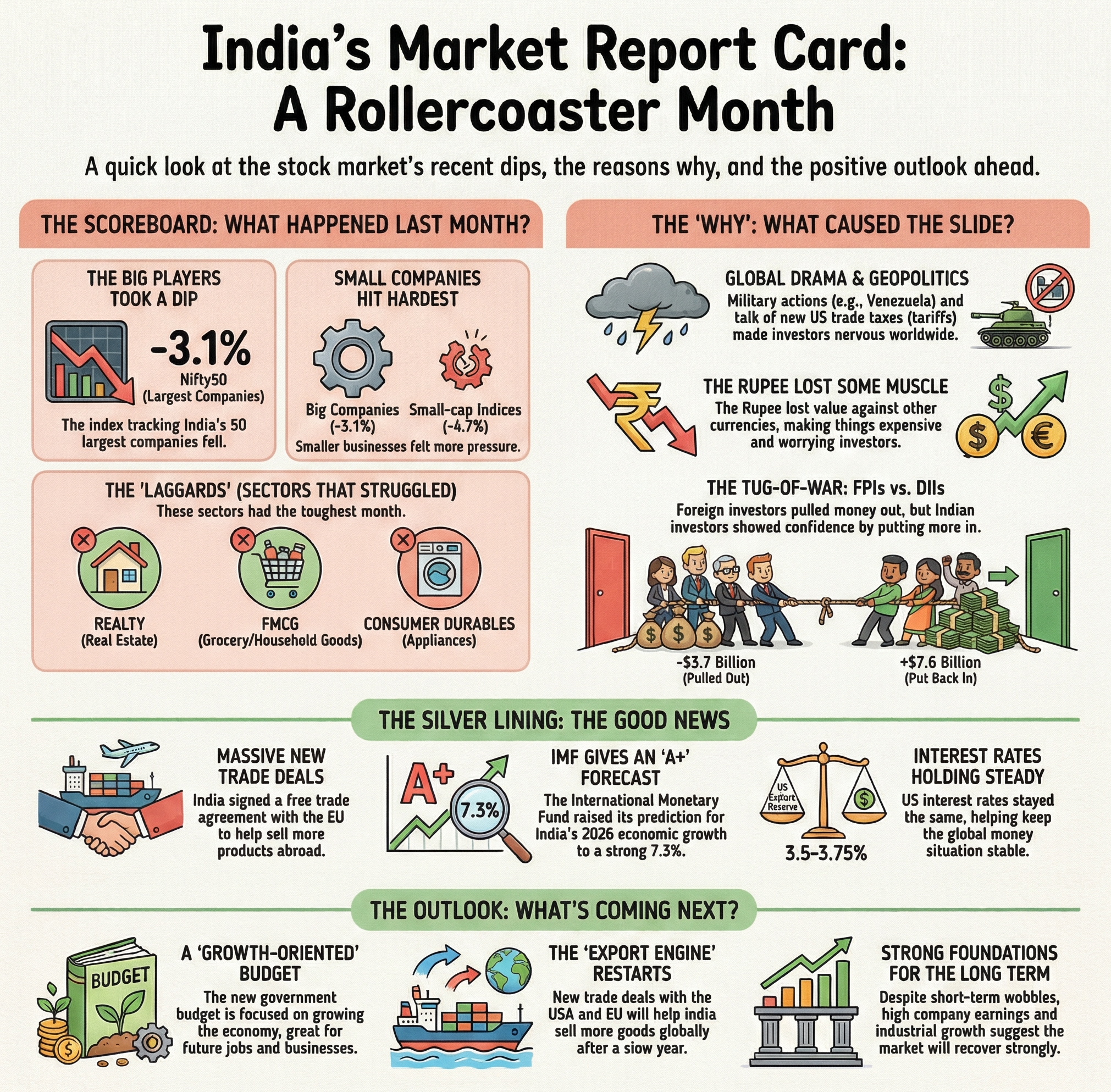

In December, the Nifty50 Index declined by 2%, ending the year with an 8.8% gain in CY2024. Mid-cap and small-cap indices outperformed, rising by 1.4% and 0.6% in December and delivering robust gains of 23.9% each for the year. Healthcare and realty were the best-performing sectors during December and 2024, while power (-7%), metals (-5.4%), and PSU (-5.2%) indices faced notable declines. Global markets ended on a mixed note, with Japan (+4.4%), Taiwan (+3.5%), and Hong Kong (+3.3%) gaining, while the US Dow Jones (-5.2%), Brazil (-4.3%), and the US SPX (-2.4%) declined.

Key developments during the month included the RBI maintaining the repo rate at 6.5% while cutting the CRR by 50 bps, and the US Fed reducing interest rates by 25 bps with fewer cuts expected next year. Japan approved a record $732 billion budget for FY2025, while the Asian Development Bank revised India’s FY2025 GDP growth forecast down to 6.5% from 7%.

On the economic front, CPI inflation eased to 5.5% YoY in November from 6.2% in October, and WPI inflation fell to 1.9% from 2.4%. Industrial growth, as measured by IIP, improved marginally to 3.5% YoY in October from 3.1% in September. The current account deficit for 2QFY25 came in at 1.2% of GDP. Institutional activity remained mixed, with FPIs buying $59 million of Indian equities, while DIIs invested $4 billion till December 31.

Market Outlook

Looking ahead, India’s structural strengths, including strong domestic demand and government-led infrastructure spending, support a positive long-term outlook for equity markets. Investors are advised to focus on quality stocks in sectors like healthcare, IT, banking, and realty, using market corrections as opportunities to build long-term positions.

Happy Investing!

_1772702186.png)