The Month that was : November 2024

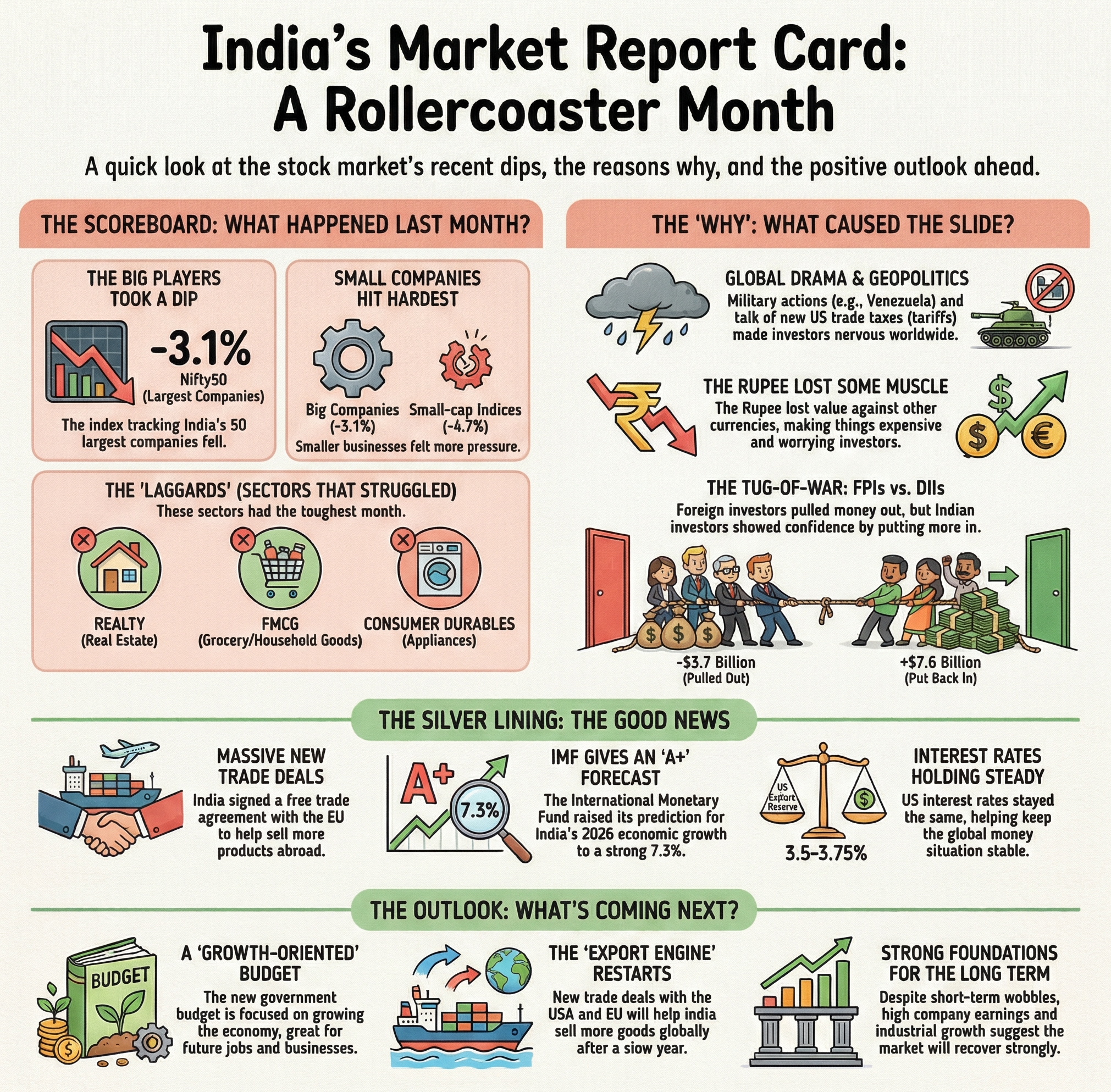

In November, Nifty50 Index witnessed volatility, closing above the 24,100 mark after dipping below 23,400, with a marginal loss of 0.3% for the month. Sectorally, IT (+6%) was the best performer, followed by consumer durables (+3%) and capital goods (+2.3%), while power (-4.3%), metals (-2.4%), and oil & gas (-2.3%) saw declines. Globally, markets ended mixed with Philippines (-7.4%), Indonesia (-6.1%), and Hong Kong (-4.4%) falling, while the US S&P500 (+7.5%) outperformed on the back of optimism over market friendly policies by newly elected President.

Sentiments for the Indian market were impacted by weak 2QFY25 corporate earnings, geopolitical tensions, and potential policy changes under the incoming US administration, though a landslide victory by the BJP coalition in Maharashtra provided some relief. India’s GDP growth for 2QFY25 slowed to 5.4%, its weakest in seven quarters on the back of slow growth in manufacturing and lower Government spending.

Outflow by FIIs continued during the month with net selling of $4.7 billion even though the quantum of outflow came down significantly compared to the previous month. DIIs purchased $5.3 billion, indicating contrasting approaches by market participants.

Market Outlook

After a disappointing economic growth and corporate earnings during Q2, high frequency indicators are pointing towards recovery in both growth and earnings in H2FY25 as Government capex picks up and consumption improves on the back of festive / marriage season and expectation of a good Rabi crop. Volatility in the markets induced by sharp FII outflow post US Presidential election results seems to be behind us and markets have stabilized at least in the near term. India’s structural strengths, such as robust domestic demand and government-driven infrastructure spending support a favorable long-term outlook for Indian equity markets. Sectors which could outperform in near to medium term are IT, Banking, Defense, Consumer Discretionary, and Industrials. Investors are encouraged to focus on quality stocks with strong fundamentals, using market corrections as opportunities to build long-term positions.

Happy Investing!

_1733748448.jpg)

_1772702186.png)