The Month that was : October 2024

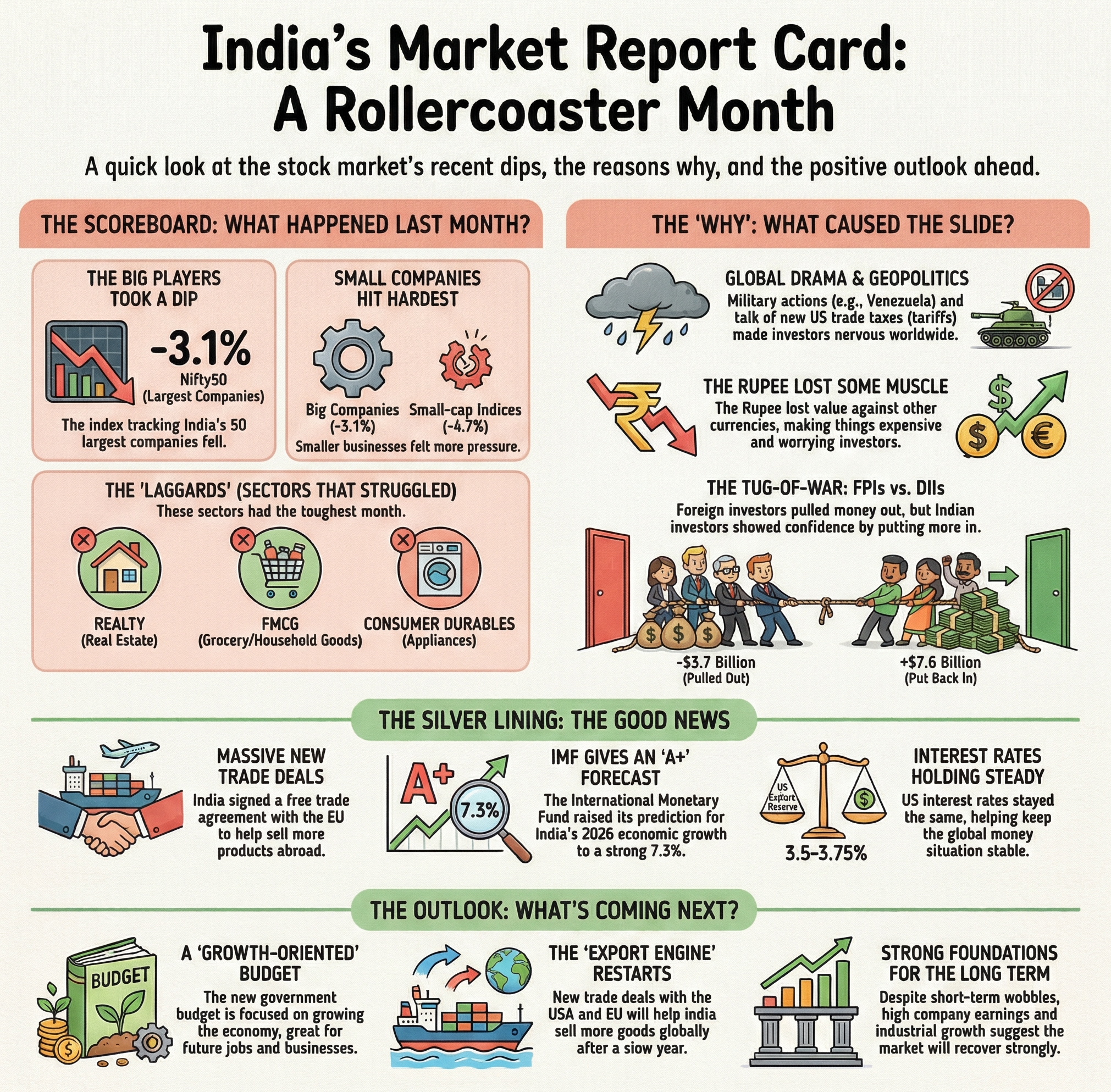

In October, the Nifty50 Index declined sharply by 6.2%, marking its steepest monthly fall since March 2020. Mid-cap and small-cap indices also experienced declines, falling 6.7% and 3%, respectively. Oil & gas (-14%) was the worst-performing sector, followed by auto (-12%) and consumer durables (-10%). Factors impacting market sentiment included a rally in Chinese equities, continued FPI outflows, weak 2Q earnings, escalating geopolitical tensions, and uncertainty around the US presidential election.

Globally, the US S&P500 and Dow Jones indices each declined by about 1%. IMF maintained India's GDP forecast at 7% for FY2025. India CPI inflation rose to 5.5% in September (from 3.6% in August), and WPI inflation also ticked up to 1.8%. IIP contracted by 0.1% in August (4.7% growth in July). 2QFY25 earnings reports highlighted a broad slowdown, with net income from 34 Nifty-50 companies rising just 1.9% year-on-year, falling short of an expected 4.5% increase. FPIs sold $12.4 billion in the secondary market while DIIs made purchases worth $12.8 billion during the month.

Market Outlook

After a market correction driven by global factors, FPI outflows and muted quarterly earnings, investor sentiment may remain cautious in near term. Donald Trump winning the US Presidential Elections could impact the Indian market negatively due to factors such as slowing down the rate cut cycle and stronger US Dollar affecting foreign inflows for emerging markets like India. On the positive side, India could be a beneficiary of China plus one trade if USA imposes higher tariffs on Chinese goods under the new administration. President Trump's policies and trajectory of earning growth in upcoming quarters will remain key factors to watch out for going ahead. While markets could remain volatile in the near term, India’s structural story of strong economic fundamentals i.e. robust GDP growth and domestic demand remain supportive over the longer term. The Government's measures to support the rural economy and infrastructure spending may continue to bolster specific sectors.

We remain positive on sectors like Banking, Consumer Discretionary, Industrials, Defence and Pharma, that are well-positioned to benefit from the economic cycle and current sentiments of the market. Investors are advised to focus on quality stocks with sound fundamentals, using market corrections as opportunities to build long-term positions.

Happy Investing!

_1772702186.png)