The Month that was : September 2024

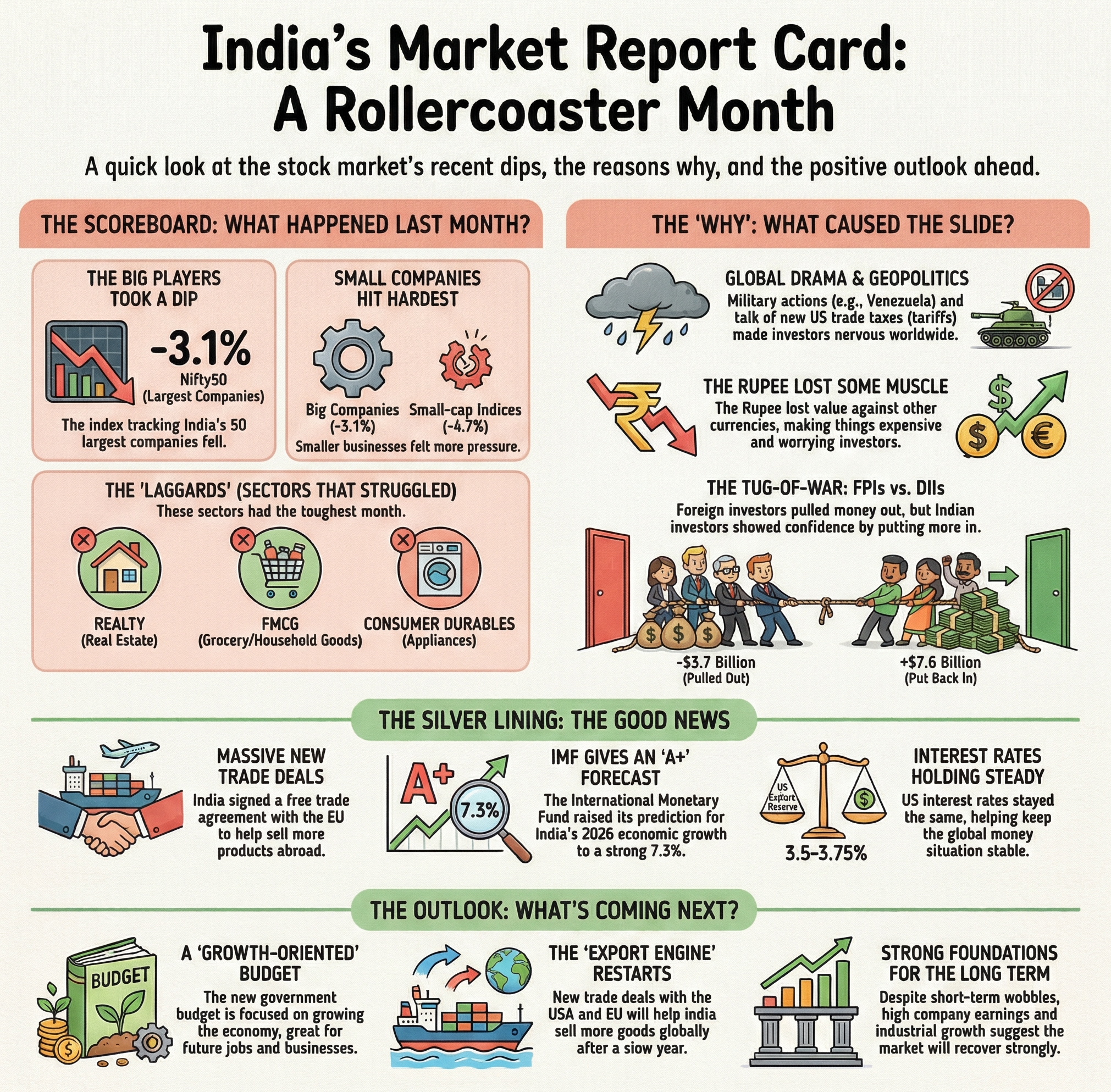

In September, Nifty50 Index posted a gain of 2.3%, supported by a strong performance in the metals sector which surged 7% on the back of China's stimulus measures. Consumer durables and power sectors followed closely with increases of 6% and 5% respectively. However, oil & gas, PSU, and IT sectors saw declines of 4%, 3%, and 3% respectively. Mid-cap and small-cap indices lagged large-cap index, rising 1.5% and falling 0.7% respectively. Investor sentiment improved globally in the second half of the month following a 50 bps interest rate cut by the US Federal Reserve and stimulus measures by China. Markets like Hang Seng and Shanghai Composite jumped 18% post stimulus announcements.

Foreign portfolio investors (FPIs) invested US$5.4 billion in Indian equities, while domestic institutional investors (DIIs) added US$3.8 billion during the month. Among India's economic indicators, a slight uptick was seen in CPI inflation to 3.7% while WPI dropped to 1.3% and IIP growth firmed up to 4.8%.

Market Outlook

After hitting an all time high and crossing 26,000 level on Nifty, markets have witnessed some correction over the last few days on the back of FII outflow. While tactically, in the near term, some FII flow could have moved from India to China post sharp outperformance of Indian markets over last couple of years, structurally Indian economy and markets are well placed to be beneficiary of robust FII inflows over the next few years on the back of strong macro and corporate earnings growth. The domestic economic landscape continues to look favorable with stable GDP growth and inflation under control. Above normal monsoon and expectation of a robust upcoming festive demand should act as a tailwind for the economy. While intermittent profit booking in the markets is normal and expected, any deeper correction, especially due to global factors, should be used to increase equity exposure.

We remain positive on domestic focused sectors such as banking, NBFC, consumer durables, industrials and capital goods which are going to benefit from either consumption demand or uptick in investment cycle. Investors are encouraged to stay focused on quality stocks with strong fundamentals, as volatility may present attractive entry points for long-term investments.

Happy Investing!

_1772702186.png)